- FAQ Variable moving average

- What is a variable moving average?

- How is a variable moving average calculated?

- What are the benefits of using a variable moving average?

- What are the drawbacks of using a variable moving average?

- Is a variable moving average the same as a weighted moving average?

- What is the Time Weighted Average Price (TWAP)?

- What is VWMA in Trading?

- Variable moving average strategy backtest and best settings

- Relevant articles about moving averages strategies and backtests

- Volume Weighted Moving Average — A Simple Upgrade

- How to Calculate VWAP?

- Steps to Calculate VWAP

- How to Read Volume Weighted Average Price (VWAP)?

- Trading Examples

- Example #1: VWMA Exits and Re-entries

- Example #2: VWMA With Price Action

- What is a Volume-Weighted Moving Average?

- Indicators Concerning VWAP

- What is the Best Setting for VWAP?

- Trading with the VWAP

- Understanding the Volume-Weighted Average Price

- How to calculate VWAP

- How Is VWAP Used?

- VWAP Tip

- How To Interpret the VWMA

- #1: Confirm Trends

- #2: Find Weakening Trends

- #3: Trade Divergences

- How TWAP can be applied to trading

- What is VWAP in Trading?

- Bottom Line

- What is a variable moving average (VMA)?

- How to Read Volume Weighted Moving Average (VWMA)?

- Indicators Concerning VWMA

- Why is TWAP Important?

- How To Use The VWMA?

- Combine VWMA with a Benchmark SMA to Highlight Volume Signals

- Final Thoughts

FAQ Variable moving average

We end the article with a few frequently asked questions about the variable moving average:

What is a variable moving average?

A variable moving average (VMA) is a technical analysis tool used to smooth out price data by creating a constantly updated average price. It works by varying the weight assigned to the most recent data points, allowing for more sensitivity to recent price movements than a standard moving average.

A variable moving average is just one of many averages a market technician can use.

How is a variable moving average calculated?

A VMA is calculated by taking the average of the most recent price data, with an emphasis on the most recent price data. The weight assigned to each price data point is determined by a user-defined parameter, which can be adjusted depending on the desired sensitivity. Most trading platforms let you put in data when you attach the variable moving average to your price data.

What are the benefits of using a variable moving average?

Using a VMA can help traders identify potential buying and selling opportunities, as well as identify potential trends. It can also be used to set stop-loss points or identify potential entry or exit points for trades.

Most traders use some form of a moving average crossover system, though.

What are the drawbacks of using a variable moving average?

The main drawback of using a VMA is that it can be overly sensitive to recent price movements, causing traders to enter or exit trades too early or too late – you get whipsawed – something that is pretty common for all moving averages.

Additionally, it can be difficult to set the correct parameters for the VMA, as it is highly dependent on the individual trader’s risk tolerance and trading style. A backtest can determine which average is the best one to use. Keep in mind that the best settings might vary from asset to asset.

Is a variable moving average the same as a weighted moving average?

No, a VMA is not the same as a weighted moving average. A weighted moving average assigns a fixed weight to each data point, while a VMA assigns a variable weight depending on the user-defined parameters.

What is the Time Weighted Average Price (TWAP)?

The time weighted average price is a trading indicator based on weighted average price that shows the average price of an instrument share as it rises and falls during a given time period.

Basically, it is the average price of a stock over a specified period of time.

Unlike the volume weighed average price (VWAP) indicator, the TWAP does not take into consideration the number of shares traded at each price point measured. You can calculate TWAP for any specified time duration.

The trader first identifies the opening, closing, high and low prices for the stock on a given day and then finds the average of those daily prices for each day he tracks the stock.

To get the TWAP, the trader takes the average of the individual daily averages.

Here is an example of the TWAP on a 30 minute crude oil chart is shown above. The displays the TWAP, which acts as resistance and then support.

This indicator is calculated for executing large trade orders and its purpose is to minimize the market impact on basket orders. Using the TWAP value, you can split a large order into a few small orders valued at the TWAP price because it is the most important value.

Once each order is executed there will be a delay for (duration / order count) minutes.

For example, if duration is 30 minutes, and the order count is 6, then there will be a (30 / 6) = 5 minute delay between each order.

Generally, traders do this to avoid letting a huge order suddenly increase the value of a given instrument in the market.

What is VWMA in Trading?

The Volume Weighted Moving Average (VWMA) also incorporates volume into the calculation but strictly uses the closing prices of securities. Like VWAP, this indicator also weighs the price data based on the volume activity that takes place in a period. Accordingly, the price data points that coincide with heavy trading volume receive more weight compared to those that coincide with lighter trading.

VWMA is also a considered lagging indicator, meaning that the values it prints only change after the price of the security it is tracking has itself changed. For this reason, VWMA is primarily used by trend followers to identify trends that they expect will continue over time.

Variable moving average strategy backtest and best settings

Before we go on to explain what a variable moving average is and how you can calculate it, we go straight to the essence of what this website is all about: quantified backtests.

Our hypothesis is simple:

Does a variable moving average strategy work? Can you make money by using variable moving average strategies?

We look at the most traded instrument in the world: the S&P 500. We test on SPDR S&P 500 Trust ETF which has the ticker code SPY.

All in all, we do four different backtests:

- Strategy 1: When the close of SPY crosses BELOW the N-day moving average, we buy SPY at the close. We sell when SPY’s closes ABOVE the same average. We use CAGR as the performance metric.

- Strategy 2: Opposite, when the close of SPY crosses ABOVE the N-day moving average, we buy SPY at the close. We sell when SPY’s closes BELOW the same average. We use CAGR as the performance metric.

- Strategy 3: When the close of SPY crosses BELOW the N-day moving average, we sell after N-days. We use average gain per trade in percent to evaluate performance, not CAGR.

- Strategy 4: When the close of SPY crosses ABOVE the N-day moving average, we sell after N-days. We use average gain per trade in percent to evaluate performance, not CAGR.

The results of the first two backtests look like this:

Strategy 1

|

Period |

5 |

10 |

25 |

50 |

100 |

200 |

|

CAR |

8.53 |

8.05 |

5.99 |

5.17 |

5 |

3.28 |

|

MDD |

-23.82 |

-33.9 |

-42.66 |

-40.24 |

-49.38 |

-49.2 |

Strategy 2

|

Period |

5 |

10 |

25 |

50 |

100 |

200 |

|

CAR |

1.09 |

1.54 |

3.5 |

4.31 |

4.48 |

6.21 |

|

MDD |

-75.45 |

-65.93 |

-39.08 |

-41.21 |

-44.53 |

-42.69 |

The results from the backtests are pretty revealing: in the short run, the stock market shows tendencies to mean-reversion. In the long run, it is better to use trend-following strategies.

Why do we reach that conclusion?

Because if we use a short moving average, the best strategy is to buy when stocks drop below the average and sell when it turns around and close above the moving average (buy on weakness and sell on strength). It’s a classical mean reversion strategy. This can clearly be seen in the first test above for the 5-day moving average. The 5-day moving average returns a CAGR of 8.53%, which is almost as good as buy and hold even though the time spent in the market is substantially lower.

![]()

When we buy on strength and sell on weakness, in the second test in the table above, the best strategy is to use many days in the average. The longer the average is, the better. The 200-day moving average returns 6.21%, which is pretty decent.

The results from backtests 3 and 4 look like this (the results are not CAGR, but average gains per trade):

Strategy 3

|

Period |

5 |

10 |

25 |

50 |

100 |

200 |

|

5 |

0.22 |

0.33 |

1.2 |

1.85 |

4.07 |

9.2 |

|

10 |

0.22 |

0.51 |

1.15 |

2.41 |

3.85 |

9.85 |

|

25 |

0.16 |

0.52 |

1.14 |

2.09 |

4.54 |

8.78 |

|

50 |

0.22 |

0.61 |

1.24 |

2.47 |

4.34 |

8.94 |

|

100 |

0.67 |

0.76 |

1.32 |

1.96 |

4.31 |

8.79 |

|

200 |

0.53 |

0.66 |

1.87 |

3.19 |

4.71 |

7.72 |

Strategy 4

|

Period |

5 |

10 |

25 |

50 |

100 |

200 |

|

5 |

0.22 |

0.26 |

0.93 |

2.16 |

4.3 |

8.58 |

|

10 |

0.2 |

0.27 |

0.93 |

2.52 |

4.24 |

8.82 |

|

25 |

0.23 |

0.31 |

0.78 |

2.16 |

3.63 |

7.47 |

|

50 |

0.17 |

0.19 |

0.76 |

1.2 |

3.78 |

8.63 |

|

100 |

0.1 |

0.26 |

1 |

1.25 |

4.1 |

8.11 |

|

200 |

0.27 |

0.01 |

0.78 |

2.42 |

3.87 |

6.75 |

As expected, the longer you are in the stock market, the better returns you get. This is because of the tailwind in the form of inflation and productivity gains.

However, be aware that this is just one method of testing a moving average. There are basically unlimited ways you can use a moving average and your imagination is probably the most restricting factor!

Relevant articles about moving averages strategies and backtests

Moving averages have been around in the trading markets for a long time. Most likely, moving average strategies were the start of the systematic and automated trading strategies developed in the 1970s, for example by Ed Seykota. We believe it’s safe to assume moving averages were a much better trading indicator before the 1990s due to the rise of the personal computer. The most low-hanging fruit has been “arbed away”.

![]()

That said, our backtests clearly show that you can develop profitable trading strategies based on moving averages but mainly based on short-term mean-reversion and longer trend-following. Furthermore, there exist many different moving averages and you can use a moving average differently/creatively, or you can combine moving averages with other parameters.

For your convenience, we have covered all moving averages with both detailed descriptions and backtests. This is our list:

- Moving average trading strategies

- Simple moving average (backtest strategy)

- Exponential moving average (backtest strategy)

- Hull moving average (backtest strategy)

- Adaptive moving average (backtest strategy)

- Smoothed moving average (backtest strategy)

- Linear-weighted moving average (backtest strategy)

- Weighted moving average (backtest strategy)

- Zero lag exponential moving average (backtest strategy)

- Volume weighted moving average (backtest strategy)

- Triple exponential moving average TEMA (backtest strategy)

- Variable Index Dynamic Average (backtest strategy)

- Triangular moving average (backtest strategy)

- Guppy multiple moving average (backtest strategy)

- McGinley Dynamic (backtest strategy)

- Geometric moving average GMA (backtest strategy)

- Fractal adaptive moving average FRAMA (backtest strategy)

- Fibonacci moving averages (backtest strategy)

- Double exponential moving average (backtest strategy)

- Moving average slope (backtest strategy)

We have also published relevant trading moving average strategies:

- The 200-day moving average strategy

- Trend-following system/strategy in gold (12-month moving average)

- Trend following strategies Treasuries

- Is Meb Faber’s momentum/trend-following strategy in gold, stocks, and bonds still working?

- Trend following strategies and systems explained (including strategies)

- Does trend following work? Why does it work?

- A simple trend-following system/strategy on the S&P 500 (By Meb Faber and Paul Tudor Jones)

- Conclusions about trend-following the S&P 500

- Why arithmetic and geometric averages differ in trading and investing

Volume Weighted Moving Average — A Simple Upgrade

For traders who already use the SMA, adding the VWMA is a simple way to improve market analysis.

Here, we used the look-back period of 20 as it is a typical setting for short-term trading. You can apply the same concept using other look-back periods that are consistent with your trading time-frame.

Using a VWMA with an SMA resembles a dual moving average system like the 9/30 trading setup. However, a typical dual moving average system does not feature volume at all.

This approach does more than stretching the SMA along the same dimension. It adds a new dimension to it with the volume weighting.

Two points to note:

- The space between the VWMA and the SMA reflects the effects of volume-weighting. Thus, when the two moving averages are entwined, it’s a sign of a listless market. In such cases, avoid drawing firm conclusions.

- The VWMA tends to stay below the SMA even in long-lasting bull markets. I’ve observed that this tendency is especially strong among equities over extended periods. Factor this in as you dive deeper into this approach.

In all, the VWMA offers a simple and effective upgrade. Try it out on your charts, and see if it complements your trading strategy.

The article was first published on 3 February 2015 and updated on 18 May 2020.

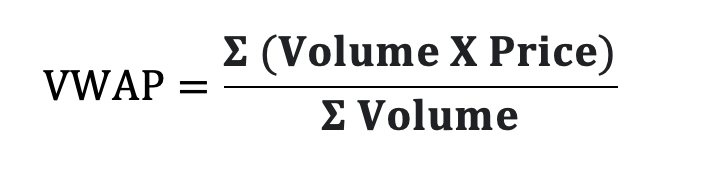

How to Calculate VWAP?

The VWAP formula equals the sum of each dollar transaction divided by the total volume of shares traded between the market open and the latest intraday time print.

Steps to Calculate VWAP

1. Calculate the Average Price from the opening bell

[(Highest Price + Lowest Price + Closing Price)/3)]

2. Multiply this Average Price with the Volume from the opening bell

(Typical Price x Volume)

3. Calculate the Aggregate Total of Average Price

Aggregate(Typical Price x Volume)

4. Find the Aggregate Total of Volume

Aggregate (Volume)

5. Divide the Aggregates as shown in the VWAP formula

VWAP = Aggregate (Typical Price x Volume) / Aggregate (Volume)

How to Read Volume Weighted Average Price (VWAP)?

At a basic level, the use case of VWAP is similar to the use case of a simple moving average. When prices rise above the VWAP, it potentially indicates that the security is establishing or has already established an uptrend, and when they fall below it, it may signal an imminent or continuing downtrend. Some traders view price alone as an insufficient determinant of trend and believe that an increase in volume is needed to confirm a new trend. These traders in particular are inclined to use VWAP to set rules for their trading strategies and that are based on trends.

Trading Examples

Now that we have a sense of how to interpret the VWMA, let’s look at how it might help us in our trading.

Example #1: VWMA Exits and Re-entries

- The market was in an established bull trend. The VWMA was above the SMA for most of the trend.

- At this point, the moving averages switched over. Although it was premature to consider a bearish position, traders who were already long found their perfect exit.

- After some initial entangling, the two moving averages showed a clear gap with the VWMA below. It warned us against entering into any bullish setups in this market consolidation.

- Finally, with this bullish trend bar, the VWMA rose above the SMA. Although the two lines entwined subsequently, this development signaled a change that favored the bulls.

- With the VWMA cueing us in, these bullish reversal bars were potential trade triggers.

Example #2: VWMA With Price Action

One pitfall of using indicators is that you fixate on the indicator signals. In this case, the crossovers between the VWMA and SMA. The consequence is that you neglect price action.

This is why I often advise new traders to start with price action.

Let’s take a look at this example to highlight this point.

- Although the VWMA dipped below the SMA at this point, the candlesticks remained above the moving averages. Price action did not show any bearish patterns. On the other hand, the long lower shadows of the candlesticks reflected buying pressure.

- A trend channel line overshoot took place at the top of the trend. A channel overshoot serves as an early warning for potential reversals.

- When the VWMA crossed below the SMA again, the price action was in stark contrast with that of Point #1. The market just broke a bull trend line with a streak of three bear trend bars.

The key here is the difference between the two bearish VWMA signals. If you focused only on the indicators, you would have missed out on what’s really happening in the market.

So don’t forget that indicators are helping us to analyze price action.

What is a Volume-Weighted Moving Average?

Compared to indicators like the On-Balance Volume and Ease of Movement, this is a straightforward indicator.

An SMA is an average of the past N closing prices. It gives the same weight to every closing price.

3-Day SMA = (C1 + C2 + C3) / 3

A Volume-Weighted Moving Average is the same, except that it gives a different weight to each closing price.

And this weight depends on the volume of that period. For instance, the closing price of a day with high volume will have a greater weight on a daily chart.

3-Day VWMA = (C1*V1 + C2*V2 + C3*V3) / (V1+ V2+ V3)

E.g., if the volume of day 3 (V3) is higher, its closing price (C3) will have a more substantial effect on the computed value.

The chart below will help you appreciate the impact of volume weighting.

- After a market rise, the closing prices remained high at this point.

- But their volumes were falling. Hence, the VWMA gave these points less weight.

- However, the SMA did not adjust any weights. Hence, although the VWMA continued rising, it did not increase as much as the SMA. This behavior led to the SMA crossing above the VWMA.

- Here, the VWMA crossed above the SMA. Can you figure out why?

Indicators Concerning VWAP

1. Using VWAP to Set Buy Order

Experienced traders often use stop and limit orders to specify their entries ahead of time rather than using a market order that accepts the current price offered by market makers. Trading strategies based on VWAP naturally fit with this approach. For long setups, traders that practice trend following are likely to place a stop order above the VWAP, whereas mean-reversion traders may place a limit order below it.

2. Using VWAP to Set Sell Order

Similarly, professional traders approach their craft with defined exit parameters guiding their trades. VWAP can be useful in this respect because it can help a trader exit a position once a trend has changed. Mean reversion traders looking to short may want to execute a sell order above the VWAP because it means the security will be sold at a price above the average.

What is the Best Setting for VWAP?

The VWAP is a lagging indicator, requiring a strict set of rules to use it effectively. Traders have two options when using VWAP: to focus on trends or mean reversion. For those using trends as the foundation for a trading strategy, a strong uptrend in the price of a security (above the VWAP) signals the movement may continue.

Mean reversion traders should use short periods to determine the average price of an asset and anticipate a turnaround. For example, they can set the VWAP to one to three (1-3) hours to identify a “fast” moving reversal in a security’s price. It will ensure the trader reacts fast enough to take a position before most traders take similar action.

Trading with the VWAP

VWAP indicates a bullish sentiment when prices are above it and bearish sentiment when prices are below it.

In a bullish market, traders can use VWAP in a pullback. For example, a security that is on an extended movement upwards makes a change in the opposite direction. Since the price is above VWAP (indicating bullish conditions), mean reversion traders can buy that security. They enter a long time and wait for the price of the asset to rise once more. Having a stop-loss level is necessary for the success of this strategy.

When markets are showing bearish sentiment, traders can use VWAP after identifying a breakout. Traders identify a security that holds a strong resistance level but starts to show a price increase accompanied by higher traded volumes. Since the level of activity in the market is still low, it signifies that the security has not gained adequate attention. Traders can take a long position, anticipating that a change in the market condition will increase interest in the security.

Understanding the Volume-Weighted Average Price

VWAP is calculated by totaling the dollars traded for every transaction (price multiplied by the volume) and then dividing by the total shares traded.

VWAP = Cumulative Typical Price x Volume/Cumulative Volume

Where Typical Price = High price + Low price + Closing Price/3

Cumulative = total since the trading session opened.

How to calculate VWAP

By adding the VWAP indicator to a streaming chart, the calculation will be made automatically. However, to calculate the VWAP yourself, follow the steps below.

Assume a 5-minute chart. The calculation is the same regardless of what intraday time frame is used.

- Find the average price the stock traded at over the first 5-minute period of the day. To do this, add the high, low, and close, then divide by three. Multiply this by the volume for that period. Record the result in a spreadsheet, under column PV.

- Divide PV by the volume for that period. This will produce the VWAP.

- To maintain the VWAP throughout the day, continue to add the PV value from each period to the prior values. Divide this total by total volume up to that point.

To make Step 3 easier in a spreadsheet, create columns for cumulative PV and cumulative volume and apply the formula to them.

How Is VWAP Used?

VWAP is used in different ways by traders. Traders may use VWAP as a trend confirmation tool and build trading rules around it. For instance, they may consider stocks with prices below VWAP as undervalued and those with prices above it, overvalued. If prices below VWAP move above it, traders may go long the stock. If prices above VWAP move below it, they may sell their positions or initiate short positions.

Institutional buyers including mutual funds use VWAP to help move into or out of stocks with as small of a market impact as possible. Therefore, when they can, institutions will try to buy below the VWAP, or sell above it. This way their actions push the price back toward the average, instead of away from it.

VWAP Tip

VWAP’s incorporation of volume is valuable to traders for what it can indicate about the degree of trading activity during short periods of time—whether the competition is taking or exiting positions.

How To Interpret the VWMA

Let’s go through a few charts to answer this question. They illustrate various ways to interpret the VWMA using the SMA as a benchmark.

In the charts below, the VWMA is blue, and the SMA is orange.

As mentioned, both moving averages must be set to the same look-back period. Here, both are using 20-period as their look-back parameter.

#1: Confirm Trends

This chart shows the FDAX futures contract in a 3-minute chart.

- The blue VWMA crossed below the orange SMA as a bear market began.

- The VWMA stayed below the SMA. This is a sign of a healthy bear trend.

For traders who are trying to let their profits run, this offers a form of assurance.

#2: Find Weakening Trends

This is a daily chart of McDonald’s Corporation (MCD on NYSE).

- The VWMA confirmed a bull trend here after a powerful gap up.

- However, at this point, the VWMA went below the SMA. Both moving averages were rising, but their relative position reversed. It was a stark warning that the bullish trend lacked volume support.

- The ominous crossover preceded a period of sideways consolidation. Then, the market gapped down to begin a bear trend.

Most moving averages issue reversal warnings through crossovers. However, as moving averages are lagging indicators, they do only after the market has reversed.

In comparison, here, combining the two moving averages led to an impressive early signal. It managed to warn us while the bull market looked intact, even before the sideways congestion began.

#3: Trade Divergences

This is a daily chart of Textron Inc (TXT on NYSE). It shows how the divergence between price and volume presents a trading opportunity.

- The price action between the two circles was erratic. Sharp falls and rises together with messy meandering.

- But the VWMA issued a surprisingly straightforward opinion. It stayed below the SMA for the entire period, suggesting that the volume was not on the side of the bulls.

- The swing above the moving averages presented a divergence. The bullish price action diverged from the bearish volume backdrop.

- For bearish traders, this divergence offered a trading opportunity. But remember that if you’re going for a reversal trade, it’s wise to act only if there’s a confluence of reasons to do so.

From a price action perspective, there was a lack of bullish streaks within the sideways consolidation. This supported the bearish volume backdrop.

- There were no three-bar bullish thrusts.

- On the other hand, there were several three-bar bearish thrusts, and the final one pushed below the moving averages.

As you can see, the VWMA is useful for tracking the price-volume context. However, it does not trigger a trade.

Consider other indicators or price patterns as your trade trigger. For instance, Example #1 below points to three bullish reversal bars that could serve as trade triggers.

How TWAP can be applied to trading

TWAP is most commonly used to distribute big orders throughout the trading day.

For example, you want to buy 100,000 Tesla (NASDAQ: TSLA) shares. Placing one big order would most likely have an impact on the market causing the price to go up.

To avoid this, you can set a time period over which you want to buy the shares. The TWAP indicator will help you spread out the large order into smaller orders and execute them over the set time period.

However, traders are advised to use the TWAP on securities that do not have any volume profile available or over short periods, since there is still the possibility of trading during a period of low liquidity where your split-up orders would still weigh on the market.

What is VWAP in Trading?

VWAP represents the ratio of a security’s traded value to its total transaction volumes in a trading session. It creates a modified average price of a security by changing the average price based on transaction volumes that occur within particular time intervals. VWAP is exclusively applied to intraday timeframes, so the indicator is a favorite among traders who operate within shorter time horizons, such as day traders.

Accordingly, VWAP (as the name suggests) takes the average price and the traded volume weights of a security during a specific period to signal strength or weakness of price action.

Even though VWAP relies on intraday data, it is still technically considered a lagging indicator. Since the VWAP calculates an average price to volume value from the start of the opening bell, it can be used to confirm intraday trends, signaling to traders whether to take a short or long position depending on whether the metric is falling or rising, respectively.

Bottom Line

The TWAP trading strategy and indicator is a helpful tool that traders use to enter and exit a trade. This simple trading strategy allows traders to compare stock price points over time.

It is closely linked to the volume-weighted average price, which shows the average price at which a security has traded over time, weighted against its trading volume. Many traders use this indicator along with candlesticks on their trading charts.

While mastering this indicator won’t happen overnight, it is indeed worth it, given how vital it is for day traders to have a clear picture and the best conditions to make an informed decision.

And the TWAP offers just that – it can enhance your trading strategy and simplify decision-making process.

What is a variable moving average (VMA)?

Also known as the volatility index dynamic average (VIDyA), the variable moving average (VMA) is an exponential moving average with a volatility index factored into the smoothing formula. Strictly speaking, the VMA is a modified version of the VIDyA: while the VIDyA uses standard deviation as the volatility index, the VMA uses the Chande Momentum Oscillator to measure volatility.

Both were introduced by Tushar S. Chande in 1992 and 1995 respectively. The main idea behind a variable moving average is to dynamically adapt an exponential moving average to a trend’s volatility.

![]()

Traditional moving averages cannot compensate for sideways moving prices versus trending markets and often generate a lot of false signals. For example, longer-term moving averages are slow to react to reversals in trend when prices move up and down over a long period. But the VMA regulates its sensitivity and lets it function better in any market conditions by using automatic regulation of the smoothing constant

The VMA belongs to the group of Adaptive Moving Averages which are also known as Intelligent Moving Averages. Its sensitivity improves by assigning more weight to the ongoing data as it generates a better signal indicator for short and long-term markets.

How to Read Volume Weighted Moving Average (VWMA)?

How traders interpret the VWMA output depends on the style of the trader, the relationship of the indicator to the price of the security, and the shape of its slope. For example, if the price sits above the VWMA and the slope of the VWMA points upwards, this pattern suggests that the security is trending higher. Trend followers would be likely to take or hold long positions.

Similarly, if the price of a security sits below the VWMA and the slope of the VWMA points downwards, it suggests the price is trending lower. Here a trend follower would take or hold a short position under these market conditions.

Indicators Concerning VWMA

Usually, traders use VWMA together with other indicators, for example, a Simple Moving Average (SMA). Combining them offers traders several insights:

1. Determine the occurrence of trends

A VWMA that closely follows the SMA signals increased volume accompanied by higher buying and selling. As a result, traders can decide what position to take.

2. Confirm the existence of trends

A divergence between the VWMA from the SMA suggests strength in a trend. In this case, the VWMA enables traders to identify market trends and determine their strengths.

3. Signify a directional change

The combination of the VWMA and price (with price crossing the VWMA) can indicate a directional change in the trend. Accordingly, traders should reconsider their position in the market.

Why is TWAP Important?

There are several reasons why TWAP matters.

The indicator gives more weighting to the most recent price changes, while still taking into consideration past data. It is a great trading tool when combined with other indicators, to help determine a trend.

Here are some of the benefits it can offer:

- TWAP is an excellent solution for executing orders over a period of time in smaller parts instead of a single large order in one go. For example, if your trading algorithm gives you a buy signal and you want to buy 10,000 shares of a stock. You can reduce the impact on the market with the option to slicing this order in small orders, say, 250 or 500 each hour/minute.

- It allows traders to distribute their orders throughout the day without having their positions known to rival traders or disturbing price in the market.

- It is great for people who do high-frequency trading or other forms of quantitative trading such as algorithmic trading.

- It minimizes impact costs and is a simple indicator to use as part of your research.

- It does not put affect market price with the execution of the entire big order.

How To Use The VWMA?

Now we know what goes into this volume indicator and how it behaves.

Next, let’s think about how to use it to improve our trading decisions.

You can:

- Use its slope as a trend filter.

- Compare the price to its moving average to decipher momentum.

- Watch the moving average as a support or resistance level.

For a price action trader, these are reliable methods to trade most moving averages, including the SMA and EMA.

But should we deploy the VWMA like a standard moving average?

No.

The tactics above are reasonable for most moving averages. But they miss the point of the VWMA because they do not make use of its unique integration with volume data.

To take full advantage of the VWMA, use it together with an SMA.

Combine VWMA with a Benchmark SMA to Highlight Volume Signals

An SMA does not include volume weighting. Hence, by comparing a VWMA to an SMA, you can immediately decipher the impact of adding volume data.

The SMA is a benchmark. And for it to be a valid benchmark, choose the same look-back period for both the SMA and the VWMA.

By doing so, we ensure that the only difference between the two moving averages is volume weighting.

What matters here is the gap between the VWMA and the SMA. Their difference highlights the effect of volume weighting.

Generally, the volume should increase along with the trend and decrease against it.

- If the VWMA is above the SMA, it means that volume has been higher on up days (days when the market closed higher).

- If the VWMA is below the SMA, it shows that down days saw higher volume.

Final Thoughts

Both the volume-weighted average price (VWAP) and the volume-weighted moving average (VWMA) can be useful indicators to guide the decisions of traders.

VWAP is an intraday measure that calculates the aggregate of the average price at specific time intervals, and adjusts the number based on weighted transaction volume. The indicator includes all the data over a given period, and the calculation starts at the beginning of a trading session. VWAP helps short term traders to determine the average price of a security by factoring in transaction volumes.

VWMA is a moving average that calculates the average closing price weighted by volume. It’s primarily used outside of intraday scenarios. The indicator takes the closing prices of a security at distinct time intervals as an input period. VWMA then weighs the price of an asset based on its trading activity in a period.

And of course, it always makes sense for traders to backtest the influence of indicators like VWAP and VWMA on the forward return of securities before putting money at risk in live markets.

![Volume weighted average price (vwap) [chartschool]](http://sli24.ru/wp-content/uploads/c/b/7/cb7a8251ac72124d238a6723cc140718.jpeg)